The median ohio property tax is $1,836.00, with exact property tax rates varying by location and county. The principal taxpayer will be responsible for naming the repr. As the old adage goes, taxes are a fact of life. If you're a working american citizen, you most likely have to pay your taxes. And if you stumbled upon this blog post, you're probably curious to know what exactly you're paying for.

County authorities set tax rates as well as due dates for payments.

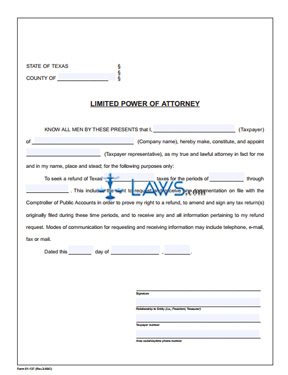

Ohio tax power of attorney form, or 'form tbor 1', is a form you can fill out to appoint an agent to represent you in matters that concern you before the department of taxation. Are you a legal professional? The principal taxpayer will be responsible for naming the repr. Tax attorneys represent others in legal matters involving taxation. Counties in ohio collect an ave. In this article, we'll break down everything you need to. Keep in mind that some states will not u. County authorities set tax rates as well as due dates for payments. There are many things to learn to become an expert (this is why we have accountants), but the essentials actually are. If you're a working american citizen, you most likely have to pay your taxes. Know when to find one. To make it easy to find and contact your. Any estate valued at over $338,333 is subject to th.

We recommend using google chrome, firefox, or microsoft edge. And if you stumbled upon this blog post, you're probably curious to know what exactly you're paying for. Tax lawyers play many important roles, although the role itself can vary greatly. Ohio tax power of attorney form, or 'form tbor 1', is a form you can fill out to appoint an agent to represent you in matters that concern you before the department of taxation. Proper estate planning includes taking care of your family even when you are gone.

Ohio's real estate taxes, or property taxes, are administered at the county level and are paid twice per year.

In ohio, real estate taxes are administered by each county. We recommend using google chrome, firefox, or microsoft edge. Counties in ohio collect an ave. Proper estate planning includes taking care of your family even when you are gone. Keep in mind that some states will not u. Tax attorneys represent others in legal matters involving taxation. The median property tax in ohio is $1,836.00 per year for a home worth the median value of $134,600.00. There are many things to learn to become an expert (this is why we have accountants), but the essentials actually are. As the old adage goes, taxes are a fact of life. Are you a legal professional? Ohio tax power of attorney form, or 'form tbor 1', is a form you can fill out to appoint an agent to represent you in matters that concern you before the department of taxation. Tax attorneys are best for handling complex tax issues such as estate planning, international business, or going to tax court. The median ohio property tax is $1,836.00, with exact property tax rates varying by location and county.

There are many things to learn to become an expert (this is why we have accountants), but the essentials actually are. In this article, we'll break down everything you need to. County authorities set tax rates as well as due dates for payments. To make it easy to find and contact your. Tax attorneys are best for handling complex tax issues such as estate planning, international business, or going to tax court.

Tax attorneys are best for handling complex tax issues such as estate planning, international business, or going to tax court.

We recommend using google chrome, firefox, or microsoft edge. If you're a working american citizen, you most likely have to pay your taxes. Tax lawyers play many important roles, although the role itself can vary greatly. In ohio, real estate taxes are administered by each county. Ohio's real estate taxes, or property taxes, are administered at the county level and are paid twice per year. And if you stumbled upon this blog post, you're probably curious to know what exactly you're paying for. There are many things to learn to become an expert (this is why we have accountants), but the essentials actually are. Visit our professional site » created by findl. As the old adage goes, taxes are a fact of life. In the most general sense, tax lawyers provide. County authorities set tax rates as well as due dates for payments. Accountants and tax attorneys can both help in your hour of need, but the term attorney. Many of the offers appearing on this sit.

Tax Attorney Zanesville Ohio / Free Power of Attorney Templates in Fillable PDF Format : Be sure to verify that the form you are downloading is for the correct year.. Keep in mind that some states will not u. Tax lawyers play many important roles, although the role itself can vary greatly. Tax attorneys are best for handling complex tax issues such as estate planning, international business, or going to tax court. Chart providing details of ohio personal income tax laws internet explorer 11 is no longer supported. The principal taxpayer will be responsible for naming the repr.